We've heard it time and again for our parents and fellow well advised peers, investing is key to a secure future. But with a wealth of information out there floating around, you would be well within your rights to ask what exactly is the best way to invest as a young person? This seems like it would be something we should be taught about in school along with maths and science, but for the most part we're left wading in a paddling toddler pool of confusion. As it turns out, there are a few simple rules that you can put in place before you even set foot into the complicated world of finance.

What is investing?

To put in simply, investing refers to the putting of [money or assets] into financial schemes, shares, property, or a commercial venture with the expectation of achieving a profit.

What should you do before deciding to invest?

We’ve all seen the many advertisements where person a) and person b) make the same salary but person a) has a super provider offering a better return, and by the time they retire she has thousands more in her account than person b). The essential lesson here is that compound interest is a useful and powerful tool that over time can make a huge difference to your investment.

Start sooner rather than later

As previously mentioned, time can add a great deal of value to your investments, so starting sooner is always ideal. If you start saving while you’re in your 20's, even if it’s only a small amount, you’d have time on your side to expand your wealth. A little now can add up to a lot later, especially with the help of compounding interest. Investing makes it fairly straight forward in that you can start investing with as little as $500 in a trading fund or $1000 for a self managed fund.

What should you do before investing in shares?

Before you go making impulse decisions, it’s a good idea to make sure that your finances are in good order. While there’s not much you can do in the short term about your HECS/HELP bill you have soaked up, you can make sure that your bills are all paid off and your credit card doesn’t have a mountain of debt.

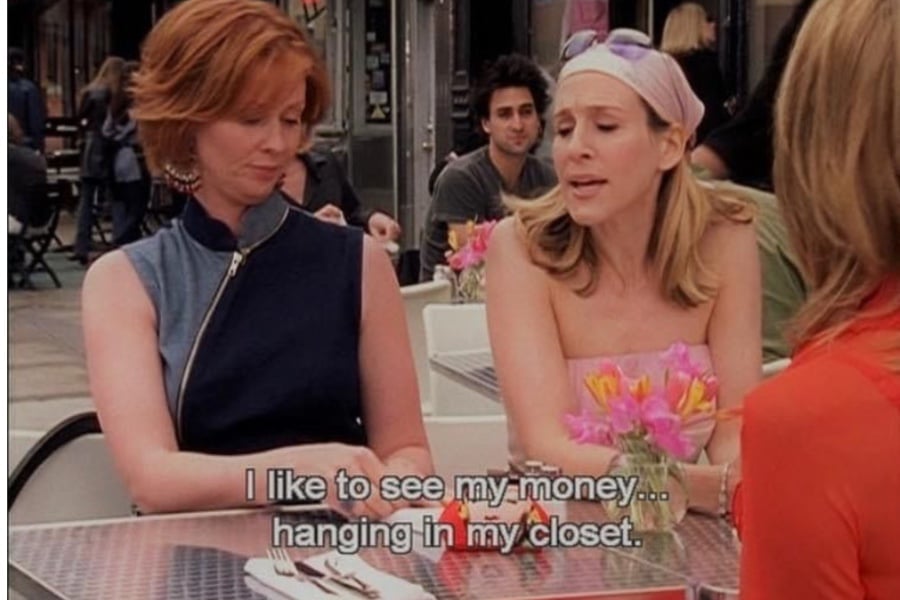

Image via Pinterest

Ways to invest

There is a seemingly endless array of ways you can invest, ASX 200 funds, emerging market ETFs and CFDs – no matter your area of interest or expertise, there’s a place for you to invest, and in many ways, that’s true. Hiring a financial adviser can be expensive, but it can also be an ideal way to find what works for you. Everyone’s situation is unique, and an investment that suits someone in your family may not suit you with entirely different financial obligations. Whether or not you decide to opt in with a financial planner, it’s probably still advisable to get an understanding of the best investment options accessible to you. Below we've compiled some of the best ways to invest and what they offer.

1. Shares

Something your grandparents no doubt have, but no less important, buying shares is still very much a part of many peoples’ financial portfolios. Buying and selling shares can be a bit scary for a first-time trader and it generally requires a bit more engagement than some of the other options. However, in this case what it does give you direct control over your investment, and you can pick and choose exactly you want in your portfolio. The age old saying of "buy low, sell high" remains true today, but it’s not the only way to cash in on stocks. You can also receive dividends if the company makes a profit. Buying individual shares is perhaps not the most beginner-friendly and you will need to consider the risk element involved in this type of investing. However, it is often easily customisable to your needs and interests.

2. ETFs

Bought and sold like a share, an ETF puts together the of money of varying investors that is then used to purchase shares across a portion of the market. It's best to see it as of it as a little investment portfolio customised into one investment, which can be bought and sold on an exchange – exactly like a share. So, every time you invest in an ETF you are in effect making a small investment in each of the companies captured in the ETF’s portfolio. ETFs are a fairly straightforward investment option, and cover a wide variety of market sectors.

4. Superannuation

So this here is very much a money where you can't see it option. You won't be able to enjoy your money until you retire but putting more money into your super early will mean you have more later. Current super regulations allow you to invest upwards to $27,500 a year [inclusive of employer contributions and personal contributions].

5. Property

Possibly the most utilised in the young adult market, despite the property market proving difficult to break into, it is still possible to get in on the action. The cost of renting does make it tricky to save up a deposit for a home, but if you manage to work away at saving a portion of your income, then you can take advantage of a lower interest rate. The most enticing part here is, investing in property that is 1) a place to live and 2) the opportunity to sell the property in the future for a profit.

6. Cryptocurrency

In the lsat few years cryptocurrency has taken us under its chokehold and is especially popular among those young and technological of us. What will likely be the way of investing in the future, If you’re starting out and want to learn more about the pros and cons of investing in it, you can take a look at our breakdown of it here.

7. Term Deposits

For those less risk adverse, he promise of a term deposit is a little more enticing. When you invest in a term deposit through a bank or credit union, you sign up to set aside an amount of money for a set time period [a term], during which you will earn interest on your investment. Term deposits are popular with investors who like to know they are getting a certified return over the fluctuations of the stock market. However, those returns are considerably less for those of shares and EFTs.

If you're interested in finding out a more info into all things finance, take a look at our in depth chat with Brooke Roberts on how to get started with shares.

Image: Pinterest